As one of the largest states in terms of economic prowess and population, California also happens to be one of the largest issuers of municipal bonds. As such, the state’s bonds can be found predominately in several national municipal bond funds. At the same, as a high-tax state, California munis are a top draw for investors living within the Golden State’s borders. So, when concerns about California’s finances creep into the news, it makes sense for investors to get nervous.

These days, investors are getting nervous: California is facing a big budget deficit.

The question is whether investors should be losing sleep over the news. California has long been a boom or bust economy, and that dynamic is playing out today. Given the state’s history of solving its budget woes, the budget deficit may not be a massive concern — but caution may be warranted.

Growing Budget Woes

California is one of the largest issuers of municipal bonds in the nation, with nearly $675 billion in debt outstanding. With such a huge amount of debt issued, concerns about the state’s fiscal health affect not only Californians but also investors looking at national municipal bond funds. For example, the $41 billion iShares National Muni Bond ETF (MUB) has about 17% of its portfolio in California bonds.

So, when news broke that California is now entering its third year of proposed budget deficits, investors rightly got concerned. All in all, California currently faces a proposed $68 billion budget deficit for 2024-25. This follows budget shortfalls of $44.9 billion for this fiscal year and $32 billion in 2023.

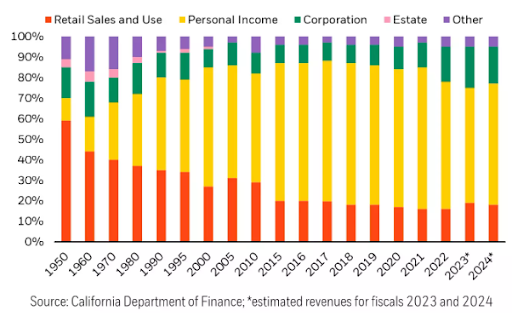

California’s woes are due to the nature of its boom-or-bust economy, specifically how the state generates tax revenues. That revenue mix has continued to shift over time, as this chart from BlackRock demonstrates.

Source: BlackRock

Today, corporate and personal income taxes make up the highest proportion of tax revenues, which makes sense.

California is home to Silicon Valley and numerous tech, media, and other high-profit businesses. As a result, California features a higher-than-national average of high earners, translating to the state having higher-than-average reliance on personal income taxes to help pay for its programs, pension, and essential services. In boom times, this translates directly into high tax revenues; the inverse is also true.

For example, when the market sank in 2022, tax revenues for 2023 fell by over 25%. The trend of lower market returns has continued into 2023, and now into 2024. Fewer firms went for an IPO and then conducted exit events. Except for a few select names, markets have moved sideways while high interest rates made borrowing more expensive. These issues directly affect top earners, with the percentage of revenues from the top 1% of taxpayers in the state falling from 50% to 39% for the 2022 tax year. These taxpayers have limped further in fiscal 2023-2024.

That is if they are continue to reside in California. Thanks to its overall high-tax environment, California features one of the highest migration rates of taxpayers fleeing the state for other lower-tax locales, making some of the tax losses permanent.

Despite California’s budget woes, investors have responded in kind. On a total return basis, which includes interest payments, the S&P Municipal Bond California Index is up only 3.31% this year. When you subtract coupon payments, the return is slightly negative.

A Good Long-Term Picture

However, the headline figures and worries about California’s debt woes along with its municipal bonds may be a bit overblown — the state still has plenty of levers to pull.

For starters, the state’s debt may not be as large or as bad as it seems. While the number outstanding is significant, net tax-supported debt as a percentage of the state’s GDP is 2.9%, whereas the national average is 2.1%. So, California is not too far off and is still manageable. Moreover, legislators recently passed a balanced budget for fiscal years 2025-2026. This includes cutting spending, raising revenues, drawing on reserves, and implementing temporary measures to patch the holes in 2024’s budget. These fixes drop the budget deficit down to just $2 billion.

At the same time, the Golden State’s rainy-day fund has grown to the maximum allowed under California law at $24 billion. This gives the state some wiggle room to pay its deficits while it waits for a boom economy to happen again.

Speaking of that boom economy, it may be here sooner than later. Tech layoffs have started to decrease, while the Fed’s path to lowering interest rates has helped boost the sector’s fortunes. New forays into artificial intelligence have also started to benefit tech firms and the state’s coffers. Meanwhile, California’s Proposition 13, which caps the amount that a property’s taxable value can only increase by 2% annually, has continued to provide a steady source of cash even though property values have suffered in recent years.

The result is that California isn’t as bad off as investors may think. Credit rating agency Fitch believes that California’s budget moves and issues are temporary, and it continues to support an investment-grade ‘AA’/Stable Issuer Default Rating.

High Potential Yields

So while California is facing some budget woes, those woes may not be as bad as first perceived. Risks such as the state’s higher-than-average unemployment rate and some resident migration issues are there, ultimately, most analysts believe that California will make it through the current malaise and move on to greener pastures.

This provides an interesting value in California bonds.

Spreads remain tight in California munis. However, the current woes and slightly negative returns have boosted yields for the Golden State’s debt. Right now, the yield-to-worst on the Bloomberg California Bond Index is 3.24%. That’s not bad at all and is slightly above the national average. The taxable equivalent yield jumps to 7.06% for top earners in California (37% federal income tax, 3.8% Affordable Care Act surtax, 13.3% CA maximum state income tax for a total of 54.1% in taxes). For non-California residents, it still offers an impressive after-tax yield of over 6%.

As a result, investors may want to consider adding California to their bond portfolios. National funds contain a lot of exposure to the Golden State and may be all you need. However, for investors who seek value, several ETFs exist offering direct exposure to the state’s IOUs.

California Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost exposure to the California municipal bond market. They are sorted by their YTD total return, which ranges from 2.8% to 4.1%. They have expense ratios between 0.08% and 0.65% and assets under management between $25M and $2.8B. They are currently yielding between 2.7% and 3.75%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PWZ | Invesco California AMT-Free Municipal Bond ETF | $829M | 4.1% | 3.23% | 0.28% | ETF | No |

| FCAL | First Trust California Municipal High income ETF | $223M | 3.8% | 2.92% | 0.65% | ETF | Yes |

| MMCA | NYLI MacKay California Muni Intermediate ETF | $25.7M | 3.1% | 3.74% | 0.37% | ETF | Yes |

| CMF | iShares California Muni Bond ETF | $2.79B | 2.8% | 2.73% | 0.08% | ETF | No |

| VTEC | Vanguard California Tax-Exempt Bond ETF | $35.2M | NA | 2.71% | 0.08% | ETF | No |

Ultimately, California’s fiscal issues are troubling, at least on the surface. Big headline deficits can be scary for many investors. However, digging further into California’s finances, budget measures, and historical economic data, we can see that things may not be too bad after all. That allows investors to buy the Golden State’s bonds at a discount and high yield.

Bottom Line

California is one of the largest economies and also one of the largest municipal bond issuers. With fiscal woes starting to take hold, it’s easy to understand why investors are concerned. But those concerns may be overblown, at least in the near term. To that end, California bonds may offer a big yield at a big discount.